You may often find yourself navigating a maze of fragmented information when attempting to engage in real estate transactions across borders. This lack of transparency and inefficiency can pose significant hurdles, making comparisons between properties difficult and increasing reliance on local expertise. Moreover, these barriers can result in higher costs and time delays, ultimately hindering your investment opportunities. As you explore the international real estate market, understanding these challenges is key to making informed decisions and fostering a more connected real estate ecosystem.

Key Takeaways:

- Information Silos: The real estate industry operates in isolated segments, leading to fragmented data that complicates transactions across different countries.

- Lack of Standardization: Without a centralized platform, stakeholders face difficulties in comparing properties, which limits investment opportunities and creates inefficiencies.

- Increased Reliance on Intermediaries: The absence of transparent systems often forces users to depend on local experts, increasing costs and time delays in the transaction process.

The Current Landscape of International Real Estate Transactions

To navigate the complex world of international real estate transactions, you must understand the significant barriers imposed by fragmented information. Various stakeholders experience difficulties as they encounter inconsistent data and varying local practices, complicating your investment decisions. Unifying these systems is crucial for fostering an environment where buyers, sellers, and investors can interact more freely and transparently.

Fragmentation of Data

Any attempt to make informed real estate decisions across countries can be hampered by the fragmentation of data. You may find yourself struggling to access comprehensive and standardized information, as insights are often locked within isolated systems. This disconnection not only limits your understanding of market dynamics but may also result in missed opportunities.

Inefficiencies in Cross-Border Transactions

Data silos create significant inefficiencies in cross-border transactions, making it challenging for you to compare properties accurately. Delays in communication and varying regulations can lead to costly mistakes and lost transactions.

Consequently, the fragmented nature of international real estate transactions can pose severe risks and challenges for you as an investor. Time delays may arise from navigating disparate systems and databases, resulting in prolonged searches for crucial information. You could find that the lack of transparency leads to misguided investment decisions, while cumbersome processes can significantly inflate costs. To maximize your opportunities and minimize risks in this evolving landscape, it’s vital to seek integrated solutions that streamline cross-border transactions.

Legal and Regulatory Barriers

Assuming you are seeking to engage in real estate transactions across countries, you may find that navigating varying legal and regulatory environments poses significant challenges, impeding your ability to make informed choices and complete transactions efficiently.

Varying Legal Frameworks

To understand the real estate landscape, you must consider that each country operates under its own legal framework, which can greatly affect property ownership, financing options, and taxation policies. This inconsistency can complicate transactions, as you need to familiarize yourself with local laws before proceeding.

Compliance Challenges

Varying legal requirements across borders can lead to significant compliance challenges for you and your investment strategy. Understanding each country’s laws is imperative, as failure to comply can result in severe penalties or the inability to finalize transactions.

Barriers to compliance often arise from the complexity of different regulations, varying requirements for property registration, and discrepancies in tax obligations. Moreover, understanding local market norms and practices can be daunting. Delays in your ability to close deals may occur as you navigate these regulations, and additional costs can accumulate when seeking local expertise or legal counsel. Ultimately, addressing these compliance challenges is vital for ensuring a smooth and successful investment experience in the fragmented real estate landscape.

Cultural Differences and Market Practices

Your ability to navigate international real estate transactions can be significantly affected by local cultural differences and market practices. Each country harbors unique customs, negotiation styles, and legal frameworks, which can create challenges when engaging with buyers, sellers, or investors from different backgrounds. Familiarizing yourself with these differences is vital for ensuring smoother transactions and building trust across borders.

Understanding Local Norms

By understanding local norms, you can better align your strategies with the expectations of the market. This knowledge allows you to avoid potential pitfalls such as miscommunication or unintentional disrespect, enhancing your reputation and effectiveness in diverse environments.

Communication Barriers

One significant hurdle in international real estate is the existence of communication barriers, which can stem from language differences and varying levels of formality in business interactions. These barriers can lead to misunderstandings, misinterpretations, and ultimately, lost opportunities.

Hence, you must be proactive in addressing communication barriers to enhance your engagement with international counterparts. Utilizing translators or local contacts can facilitate clearer discussions, while understanding cultural practices around communication—such as directness versus diplomacy—can prevent awkward scenarios. Leapfrogging these challenges can open doors to valuable insights and foster stronger connections in a fragmented market. Adopting appropriate communication styles can significantly influence the success of your transactions and lead to beneficial relationships across countries.

Technology and Innovation in Real Estate

For modern real estate transactions, technology and innovation are reshaping how you engage with the market. By integrating digital solutions, you can access information across geographical barriers, combating the fragmentation that has historically limited your ability to make informed decisions. These advancements not only enhance transparency but also streamline your experience, ultimately fostering a more connected global real estate ecosystem.

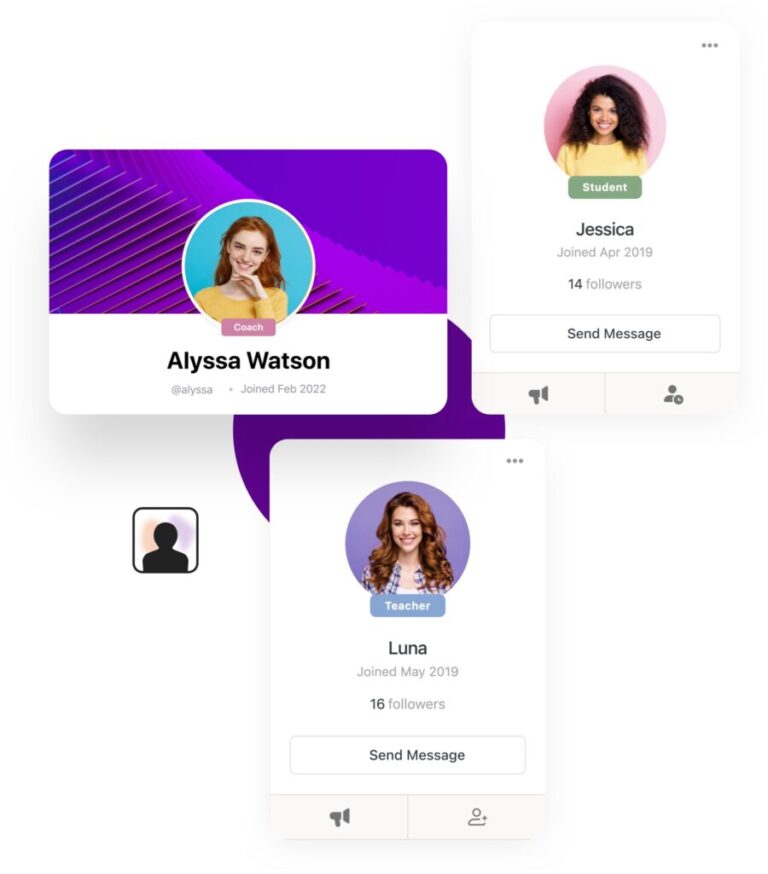

Role of PropTech

Among the various technological advancements, PropTech stands out as a transformative force in real estate. It enables you to gather insights from multiple sources without relying solely on local intermediaries, significantly reducing both time and costs associated with property transactions. With PropTech, the possibility of interacting with diverse markets is within your reach.

Digital Solutions for Streamlining Transactions

On the journey to more efficient real estate transactions, digital solutions play a pivotal role in simplifying processes for you. With platforms that centralize data and analytics, finding comparative property information across regions becomes a seamless endeavor. This access not only saves you time but also equips you with the insights to make sound investment choices.

Further, embracing digital solutions can significantly enhance your real estate experience. Tools like virtual tours, blockchain-based transactions, and automated valuation models reduce the cumbersome task of navigating disparate systems. With these innovations, you can eliminate inefficiencies and enhance transparency, empowering you to conduct transactions with greater confidence. By opting for a single, integrated platform, you gain insights that allow for better comparison of properties across different regions, thereby identifying lucrative cross-market investment opportunities.

Strategies for Overcoming Barriers

Unlike the current fragmented landscape of the real estate industry, adopting integrated strategies can significantly enhance your ability to navigate transactions across borders. By leveraging technology and collaboration, you can work towards reducing the inefficiencies and opacity prevalent in today’s market. Focused efforts on creating unified platforms and fostering partnerships will empower you to make better decisions and seize opportunities in a more connected environment.

Building Integrated Platforms

Overcoming the informational gaps in the real estate industry begins with the development of integrated platforms. These systems enable you to access comprehensive data seamlessly, minimizing the reliance on local expertise and intermediaries. By synthesizing data in one location, you can streamline your decision-making process and enhance transparency in the market.

Promoting International Collaboration

To effectively address the barriers in global real estate transactions, you must focus on fostering international collaboration. Establishing partnerships with various stakeholders—including real estate professionals, investors, and technology providers—can facilitate knowledge sharing and create a cohesive environment that supports cross-market investments.

Integrated platforms are not just tools; they are important for creating a transparent and efficient real estate ecosystem. By promoting collaboration across different countries, you can tap into a wealth of local expertise and market insights that may otherwise be inaccessible. This collaboration can unlock significant opportunities for investment while reducing barriers imposed by geographical silos. As you engage with international partners, you’ll become better equipped to navigate the complexities of global real estate, ultimately leading to greater success and innovation in your endeavors.

The Future of Global Real Estate Transactions

Many experts believe that the landscape of global real estate transactions is on the brink of transformation. With advancements in technology and a growing emphasis on data integration, the potential for a unified marketplace is becoming more attainable. This shift promises to enhance transparency and efficiency, enabling you to engage more effectively in international real estate ventures.

Trends Shaping the Market

An increasing trend towards digitalization and the use of big data is reshaping the global real estate market. You can expect to see more advanced platforms that offer real-time access to property listings and market analytics, which will facilitate better investment decisions across borders.

Opportunities for Investors and Buyers

To tap into the evolving real estate market, you have unique opportunities to diversify your investments. As barriers between countries diminish, you can explore properties that were previously out of reach, enhancing your portfolio with international assets.

The potential to seize opportunities in global real estate transactions is significant. As real estate platforms become more integrated, you will have easier access to comprehensive data across multiple regions. This accessibility allows you to compare properties efficiently, identify lucrative investments, and potentially capitalize on emerging markets. By embracing this new landscape, you can not only maximize your investment potential but also contribute to a more connected global real estate ecosystem.

Conclusion

Upon reflecting on the barriers to real estate transactions across countries, you may recognize how fragmented information and siloed data hinder your ability to make informed decisions. The lack of a centralized platform complicates your search process and increases reliance on local experts, which can lead to inefficiencies. By embracing integrated solutions that foster transparency and accessibility, you can enhance your investment strategies and explore opportunities across various regions more effectively, ultimately streamlining your real estate endeavors.

FAQ

Q: What are the main barriers to real estate transactions across countries?

A: The primary barriers include regulatory differences, cultural misunderstandings, currency exchange fluctuations, and a lack of standardized information. Each country has its own legal framework governing real estate transactions, which can create confusion for international buyers and sellers. Additionally, cultural norms surrounding property ownership, negotiation styles, and home buying processes can significantly differ, leading to potential miscommunications or conflicts. Currency variations further complicate financial transactions, necessitating careful consideration of exchange rates and potential fees. Lastly, the absence of standardized databases means that accessing accurate property information can be challenging, resulting in inefficiencies and increased costs.

Q: How does the fragmentation of real estate data impact international investors?

A: Fragmentation of data in the real estate sector leads to challenges in sourcing reliable information about properties and markets in different countries. Investors often struggle with incomplete databases, making it difficult to conduct thorough due diligence. This lack of transparency can result in missed opportunities as investors may not have access to critical market insights, property valuations, or comparable sales data. Consequently, the risk associated with foreign investments increases, which may deter international buyers from pursuing opportunities abroad. The inefficiencies tied to navigating various systems can also extend transaction timelines, further complicating cross-border deals.

Q: What solutions can help overcome the barriers to international real estate transactions?

A: Integrated solutions that provide a centralized platform for real estate transactions can significantly enhance cross-border dealings. These platforms should feature standardized data and comprehensive resources that cater to multiple countries, reducing the need for intermediaries and local expertise. Furthermore, advancements in technology, such as blockchain for secure transactions and analytics for market insights, can help streamline processes, improve transparency, and build trust among stakeholders. Lastly, fostering collaboration among real estate professionals from different regions can promote knowledge sharing and establish best practices, ultimately facilitating smoother transactions across international borders.